On Monday, January 12, 2026, President Trump announced a 25% tariff on any country that continues to do business with Iran. This move aims to cut Iran off from the global economy in response to several rising issues.

Primary Reasons for the 25% Tariff:

Punishment for Domestic Crackdown: The main reason for the new tariffs is the Iranian government’s harsh crackdown on large-scale anti-regime protests sweeping the country. U.S. officials report that hundreds of protesters have died, and thousands have been arrested in recent weeks.

Regime Change Pressure: Trump has encouraged Iranian citizens to “take over your institutions,” signaling a shift towards active regime change. The tariffs aim to further weaken an already unstable Iranian economy to force a collapse or a shift in power.

Targeting “Secondary” Trade:

Unlike previous sanctions that targeted specific companies, this 25% tariff applies to entire countries. It specifically targets Iran’s key trading partners, such as China, India, Turkey, and the United Arab Emirates, forcing them to choose between trading with Iran or keeping duty-free or lower-tariff access to the U.S. market.

Alternative to Military Action:

While the administration is reviewing military options, it uses the tariffs as a high-pressure tool to achieve diplomatic or political goals without deploying large U.S. troops.

Impact on Global Trading Partners

The announcement has quickly raised global trade tensions:

China: As Iran’s largest oil buyer, China faces the biggest impact. The 25% “Iran penalty” will be added on top of existing tariffs, potentially raising the average U.S. levy on Chinese goods to over 70%.

India: India is particularly at risk due to its trade in basmati rice and pharmaceuticals with Iran. This comes as India faces 50% U.S. levies related to its purchase of Russian oil.

Allies: Close U.S. allies like Japan and South Korea, which import small quantities from Iran, may also have to completely cut those ties to avoid the 25% tariff on their exports to the U.S.

The President cited the International Emergency Economic Powers Act (IEEPA) as the legal basis for this action, though it is currently facing legal challenges in the U.S. Supreme Court regarding its broad application.

The newly announced 25% tariff on countries trading with Iran is expected to have little effect on India, according to government sources and trade experts.

INDIA’S EFFECT

Following President Trump’s “final and conclusive” order on January 12, 2026, the Indian government and major export bodies clarified that India’s economic exposure to Iran is already too small to cause significant fallout.

1. Limited Trade Exposure

The primary reason for the minimal impact is the very low volume of trade between India and Iran:

Marginal Trade Volume: Total trade between the two nations was around $1.6 billion last year, accounting for just 0.15% of India’s overall global trade.

Non-Top Partner: Iran does not even rank among India’s top 50 trading partners.

No Oil Imports: India stopped importing crude oil from Iran in 2019 due to earlier sanctions, which removed the biggest risk factor for high-value trade penalties.

2. Focus on “Humanitarian” Goods

Most of India’s current exports to Iran consist of goods that typically fall under “humanitarian” exemptions and do not break US Office of Foreign Assets Control (OFAC) rules:

Key Exports: Major items include basmati rice, tea, sugar, pharmaceuticals, and fresh fruits.

Exporters’ Stance: The Federation of Indian Export Organisations (FIEO) stated that Indian banks and companies already deal only in permitted non-sanctioned goods, so there is “no basis to anticipate any adverse impact.”

3. Strategic and Regional Context

While the economic risk is low, some localized and strategic concerns remain:

Chabahar Port: India’s development of the Chabahar Port is a key strategic project. However, the Trump administration has previously granted exemptions for this project due to its importance for regional connectivity and Afghanistan. It is expected to remain a separate diplomatic discussion.

Basmati Rice Prices: Some local exporters worry about the decline of the Iranian currency and payment delays, which have caused domestic prices for certain rice varieties (like 1121 and 1509) to drop slightly in the last week.

Total Tariff Burden: Analysts have noted that if this 25% “Iran penalty” is added to existing 50% levies (imposed by the U.S. due to India’s Russian oil purchases), some specific Indian goods could theoretically face a combined burden of up to 75%, though this depends on the specific product schedules yet to be published.

Summary: The 25% tariff is mainly seen as a move directed at Iran’s largest remaining trading partners—particularly China (which accounts for 26% of Iran’s imports) and the UAE (30%)—rather than India, which holds a minor 2.3% share of Iran’s import basket.

IS IRAN ON EDGE

Iran is entering its third week of unrest with the kind of grim arithmetic that changes diplomatic equations: activists say over 600 people have been killed and more than 10,000 detained, while the state has tightened an information blackout that makes verification harder and escalation easier.Now the crisis is spilling outward – into the familiar geometry of US-Iran brinkmanship – with President claiming Tehran is looking for a way out, even as he threatens new punishment and keeps military options on the table.

Trump told reporters his administration is preparing for talks but may not wait: “A meeting is being set up, but we may have to act because of what is happening before the meeting,” he said on Air Force One.. He also framed Iran’s posture as weakness under pressure: “I think they’re tired of being beat up by the United States,” Trump said. “Iran wants to negotiate.”Iran’s public tone suggests defiance, not retreat.

Yet Iranian officials are also carefully signaling that diplomacy is not off the table – so long as it doesn’t look like capitulation.Iranian foreign ministry spokesman Esmail Baghaei said a channel to the US remained open, but talks must be “based on the acceptance of mutual interests and concerns, not a negotiation that is one-sided, unilateral and based on dictation.”

The people, however, said the 25% tariff announced by Trump for trade partners of Iran is expected to have a “minimal impact” on India. Iran doesn’t figure among India’s top 50 global trading partners. India’s trade with Iran during 2024-25 was worth $1.68 billion, or about 0.15% of the country’s total trade, and imports from Iran amounted to $0.44 billion.

“India’s trade value with Iran is expected to go down further in the current financial year due to external economic factors,” one of the people said.

India stopped importing oil from Iran – once the main commodity in two-way trade – in May 2019 because of sanctions imposed by Trump in his first term. This resulted in two-way trade plummeting from $17.03 billion in 2018-19 to the current low levels.

The people contrasted India’s position with Iran’s trade with its key economic partners such as China, Iraq, the United Arab Emirates and Turkiye, all of which witnessed growth in trade volumes in recent years despite crippling Western sanctions.

Iran’s total imports in 2024 were worth almost $68 billion, and the country’s leading import partners were the UAE ($21 billion or 30% of Tehran’s imports), China ($17 billion or 26%), Turkiye ($11 billion or 16%), and the European Union ($6 billion or 9%).

Indian banks have also largely reduced their involvement in payments because of fears of exposure to sanctions in their operations in the West.

However, India continues to have a significant presence in Iran’s strategic Chabahar port, with the two sides concluding a 10-year agreement on the development of a terminal at the facility on the Gulf of Oman, and the Trump administration granted a six-month exemption for US sanctions applicable to the port in October 2024.

PROBLEM TO OTHERS

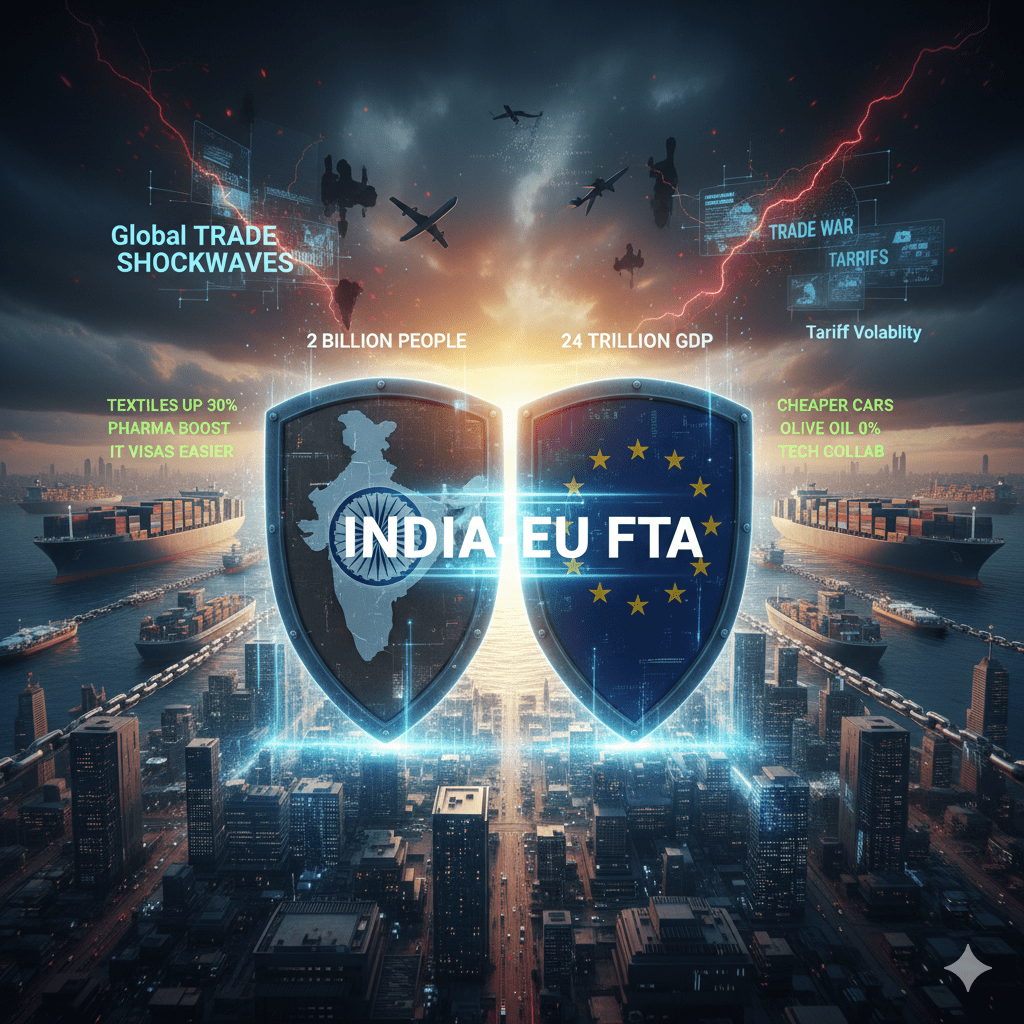

For Japan and South Korea, the risk is less about volume and more about precedent. Both countries maintain only modest trade with Iran- mostly machinery, vehicle parts and small volumes of food products – and both finalized trade arrangements with the US last year. Reuters reports that officials in Tokyo and Seoul said they are closely monitoring the situation, signaling concern that secondary tariffs could undercut hard-won trade stability with Washington.

Turkey faces a different dilemma. As a major regional trading partner of Iran, Turkey imported and exported billions of dollars’ worth of goods in 2022, according to World Bank data cited by Reuters. Ankara has historically resisted US pressure to fully sever economic ties with Tehran, and Trump’s threat raises the prospect of renewed friction between Nato allies over sanctions enforcement and trade retaliation.

Beyond those countries, Reuters notes that Iran trades with more than 140 partners globally, including the United Arab Emirates and Iraq. Many of those economies act as transit hubs or intermediaries rather than direct end-users – raising complex questions about how Washington would define “doing business” with Iran, and whether indirect trade could also trigger penalties.Trump’s threat doesn’t just target Iran’s biggest buyers – it tests how far US allies and partners are willing to align with Washington’s Iran strategy when the cost could be tariffs on all their US-bound exports.

The US-China trade truce under strainThe October agreement between Trump and Xi was narrowly constructed and always vulnerable to external shocks.It did not resolve deeper disputes over industrial policy, technology transfer or national security. Instead, it focused on freezing tariffs at current levels and restoring access to strategic materials – particularly rare earths, which China dominates globally.

During the earlier trade dispute, Beijing imposed export curbs on rare earths, highlighting a choke point Washington is keenly aware of. The truce ensured US companies could again source those minerals, which are vital for everything from smartphones to fighter jets.Bloomberg Economics data underscore how meaningful the détente was: a nearly 10 percentage-point drop in average US tariffs on Chinese imports translated into billions of dollars in avoided costs for US firms.Trump’s Iran tariff threat jeopardizes that stability by introducing uncertainty over whether China could once again become a target – this time indirectly, via its ties to Tehran.