On February 1, 2026, Finance Minister Nirmala Sitharaman presented her ninth consecutive Union Budget. This marks a significant moment in India’s fiscal history. Focusing on the theme of “Yuva Shakti” (Youth Power) and following the Three Kartavya (Duties) framework of Growth, Inclusion, and Resilience, the Budget 2026-27 lays out a plan for a “Viksit Bharat” (Developed India).

The total expenditure is set at ₹53.47 lakh crore, which includes a historic investment in infrastructure of ₹12.2 lakh crore.

1. Macro-Economic Snapshot & Fiscal Deficit

The government maintains its commitment to fiscal responsibility, balancing increased spending with debt management.

Total Budget Size: ₹53,47,315 crore (7.7% increase from FY25).

Fiscal Deficit Target: 4.3% of GDP (down from 4.4% last year).

Nominal GDP Growth: Estimated at 10% for FY27.

Debt-to-GDP Goal: Aimed at 50% by 2031 (currently 55.6% for the Central Government).

Transfer to States: ₹26.2 lakh crore (a 12.2% increase), including ₹1.85 lakh crore in interest-free loans for capital projects.

2. Personal Finance & Taxation

The main change is the introduction of the New Income Tax Act, 2025, effective from April 1, 2026, which replaces the 1961 code

with a simpler, modern framework.

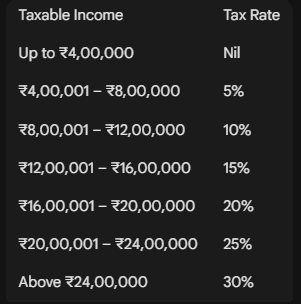

New Tax Regime Slabs (FY 2026-27)

The main tax brackets remain the same as last year, but the administrative burden has been reduced.

Key Reliefs:

– Standard Deduction: Remains at ₹75,000 for salaried employees.

– Effective Tax-Free Limit: Thanks to Section 87A rebates, individuals with a total income up to ₹12 lakh (or ₹12.75 lakh for salaried) pay no tax.

– TCS Reduction: Tax Collected at Source on overseas tour packages and education/medical remittances (over ₹10 lakh) has dropped from 5%/20% to 2%.

– MACT Exemption: Interest awarded by Motor Accident Claims Tribunals is now fully exempt from tax in budget.

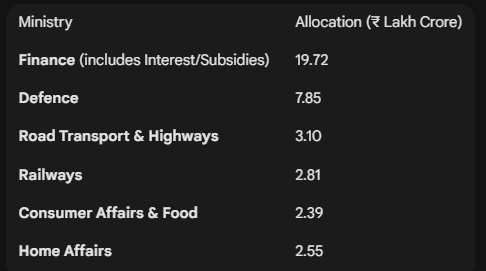

3. Infrastructure & Transport: The “Growth Connectors”

Infrastructure is still the main driver of the economy. The PM Gati Shakti plan has been expanded to cover in budget

–

Railways: Allocation of ₹2.81 lakh crore, with a focus on seven High-Speed Rail Corridors (like Mumbai-Pune, Delhi-Varanasi, Hyderabad-Bengaluru).–

Freight: A new Dedicated Freight Corridor (DFC) connecting Surat (West) to Dankuni (East).– Waterways: 20 new National Waterways will be operational soon.–

Urban Development: Mapping of City Economic Regions (CERs) with ₹5,000 crore allocated for each region to improve Tier-II and Tier-III cities.

4. Manufacturing & Technology 2.0

Budget shifts towards advanced technologies to improve India’s position in the global market.

– Semiconductors: Launch of India Semiconductor Mission (ISM) 2.0 with an increased budget of ₹40,000 crore budget.

– Rare Earth

Corridors: Set up in Odisha, Kerala, Andhra Pradesh, and Tamil Nadu to secure minerals for electric vehicles and electronics.

– Biopharma SHAKTI: A ₹10,000 crore initiative to make India a global hub for biopharma, including 1,000 new accredited clinical trial sites.

– Chemical Parks: Three dedicated chemical parks per state using a “plug-and-play” cluster model.

5. Support for MSMEs & The “Orange Economy”

To support small and medium enterprises (SMEs), the government launched several liquidity and mentorship initiatives:

– SME Growth Fund: A ₹10,000 crore fund to help small industries with equity support.

– Corporate Mitras: A group of professional mentors in Tier-II/III towns to assist MSMEs with compliance and finance.

– Mahatma Gandhi Gram Swaraj: An initiative to modernize Khadi, handlooms, and handicrafts.

6. Social Sector: Health, Agriculture & Education

Healthcare: Allocation of ₹1.07 lakh crore, focusing on cancer care (17 drugs exempted from customs duty) and mental health infrastructure.

Agriculture: ₹1.40 lakh crore. Introduction of Bharat-VISTAAR for agri-tech and climate-resilient farming.

Education: ₹1.39 lakh crore. Creation of five University Townships and “Content Creator Labs” in 15,000 secondary schools for gaming and audiovisual sectors.

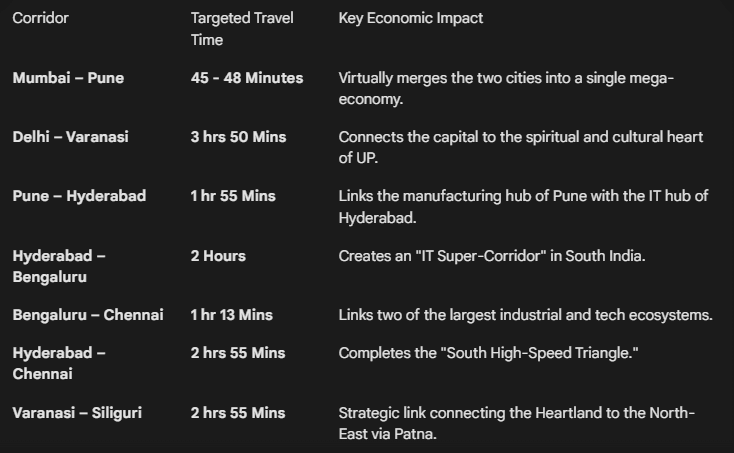

The Railway Revolution: 7 High-Speed Corridors

The Ministry of Railways received a record allocation of ₹2.93 lakh crore. A key feature is the announcement of seven High-Speed Rail (HSR) Corridors, called “Growth Connectors,” which aim to cut travel time between major economic centers to under 2-4 hours.

Business & Corporate Taxation:

The 2026 Shift

The Budget introduced the Income Tax Act, 2025, which simplifies the 60-year-old law by reducing its size by 50%.

Major Changes for Corporates & Startups:

– Share Buybacks: The tax on buybacks has shifted from companies to shareholders.

–

Small Shareholders: They benefit from being able to use the ₹1.25 lakh LTCG exemption.

–

Promoters: They face a higher effective tax of 22% (Corporate) or 30% (Individuals) to avoid tax loopholes.

–

Minimum Alternate Tax (MAT): Reduced from 15% to 14%, it is proposed to be a “Final Tax.” Companies moving to the New Tax Regime can set off accumulated MAT credit (up to 25% of normal tax liability).

– IFSC Units: Business income for units in GIFT City/IFSC will be taxed at a flat 15% (down from 22/30%) after their tax holiday.

– Safe Harbour for IT: The threshold for IT services safe harbour has been raised from ₹300 crore to ₹2,000 crore, with a common margin of 15.5%.

Financial Markets & Speculation

To curb excessive speculation in the derivatives market, the government has raised the Securities Transaction Tax (STT):

– Equity Futures: Increased from 0.02% to 0.05%.

– Equity Options: STT on the premium increased from 0.1% to 0.15%.

Frontier Tech & Strategic Sectors

The government is positioning India to take the lead in advanced technologies through several new initiatives:

– India Semiconductor Mission (ISM) 2.0: An outlay of ₹40,000 crore to shift from assembly (OSAT) to full-scale production.

– Rare Earth Corridors: A strategic approach to secure minerals like Lithium and Cobalt, reducing reliance on China.

– Data Center Tax Holiday: Foreign cloud providers will enjoy a tax holiday until 2047 if they utilize Indian data centers for global services.

– Biopharma SHAKTI: A ₹10,000 crore fund to enhance domestic production of biologics and biosimilars.

Summary of Indirect Tax Changes

The budget concentrates on boosting Indian manufacturing by lowering input costs:

– Cancer Drugs: 17 essential drugs are now exempt from customs duty.

– Critical Minerals: Duty eliminated on machinery used for processing minerals like Lithium and Copper.

– Personal Imports: Customs duty on personal goods imported via courier/post reduced from 20% to 10%.

– Electronics: Duty exemptions extended for capital goods used in making Li-ion cells.

Budget at a Glance: “Where the Money Comes From”

For every ₹1 the government collects:

– Income Tax: 21 paise

– Corporation Tax: 18 paise

– GST: 15 paise

– Borrowings: 24 paise

– Others (Customs, Excise, etc.): 22 paise