500% Tariff on India, Brazil and China by the USA: Reasons, Background and Global Implications

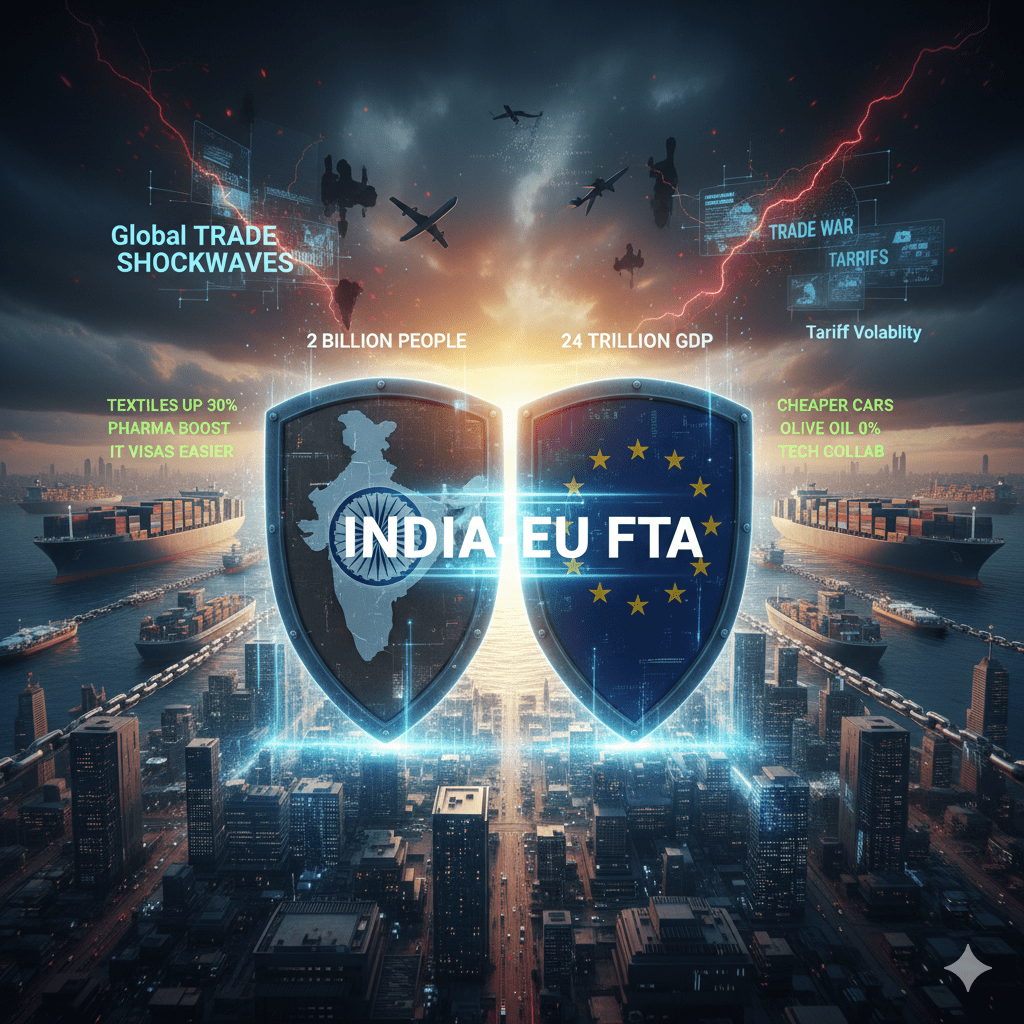

In recent months, global trade discussions have been dominated by alarming claims of a 500 percent tariff threat by the United States on countries such as India, Brazil, and China. While such a tariff level would be unprecedented in modern international trade, the debate itself reveals deep-rooted tensions in the global economic system. The issue is not just about numbers, but about geopolitics, strategic alliances, sanctions enforcement, supply chains, and the growing use of trade as a political weapon. To understand why these three countries are often mentioned together in this context, it is essential to examine the underlying reasons, economic realities, and possible consequences.

Understanding the Idea of a 500% Tariff

A 500 percent tariff would effectively act as a trade blockade, making imported goods prohibitively expensive and commercially unviable. Such tariffs are not meant to regulate trade but to coerce policy changes. Historically, the United States has used high tariffs or sanctions to pressure countries over national security, unfair trade practices, or geopolitical conflicts. The current discussion around extreme tariffs is linked to a more aggressive trade posture aimed at reshaping global alliances and enforcing compliance with US-led economic and political priorities.

Why India Is Being Discussed

India’s inclusion in tariff-related debates largely stems from its independent foreign policy, particularly its continued economic engagement with Russia. Since the Ukraine conflict, India has significantly increased imports of Russian crude oil, fertilizers, and coal, often at discounted prices. From New Delhi’s perspective, these purchases are driven by energy security and inflation control, not political alignment.

However, Washington views such trade as indirectly undermining Western sanctions on Russia. A proposed high tariff on Indian goods would be designed to discourage continued trade with sanctioned nations. Additionally, trade disputes over market access, data localization rules, digital taxes, and pharmaceutical pricing have long existed between India and the US. Though India and the US are strategic partners, their economic relationship is not without friction.

A tariff shock of this scale would severely impact Indian exports such as pharmaceuticals, textiles, engineering goods, gems and jewelry, and auto components. It could also strain the broader India–US strategic partnership, which currently includes defense cooperation, technology sharing, and Indo-Pacific security collaboration.

Why Brazil Is in the Spotlight

Brazil’s case is different but equally complex. As a major commodity exporter, Brazil plays a critical role in global markets for soybeans, beef, iron ore, and energy. The country has deep trade ties with China and maintains pragmatic relations with Russia, especially within multilateral forums like BRICS.

From the US perspective, Brazil’s growing participation in alternative economic groupings that challenge Western dominance—such as BRICS expansion and discussions around non-dollar trade—has raised concerns. Additionally, Brazil’s agricultural exports often compete directly with American farmers. Trade disputes over subsidies, environmental standards, and market access have frequently surfaced.

A potential tariff threat against Brazil would aim to achieve multiple objectives: curb its strategic drift away from US influence, protect domestic American industries, and pressure Brazil to align more closely with Western geopolitical positions. For Brazil, such tariffs could hurt agribusiness, reduce export earnings, and destabilize its economy, which relies heavily on foreign trade.

Why China Remains the Primary Target

China is the most obvious and longstanding focus of US trade aggression. The US–China trade war, which intensified during Donald Trump’s presidency, fundamentally altered global supply chains. Accusations against China include unfair trade practices, intellectual property theft, state subsidies, currency manipulation, and national security threats.

Unlike India and Brazil, China is viewed as a systemic rival rather than a partner. High tariffs are used not only to reduce trade deficits but also to slow China’s technological and industrial rise. Discussions around extreme tariffs reflect Washington’s frustration with the limited impact of previous measures.

China’s dominance in sectors like electronics, electric vehicles, rare earth minerals, and solar technology has intensified fears in the US about deindustrialization and strategic dependence. A 500 percent tariff, even as a threat, signals a willingness to escalate economic confrontation to unprecedented levels.

Geopolitical Motives Behind Extreme Tariffs

The common thread linking India, Brazil, and China is not trade volume alone, but strategic autonomy. All three countries resist aligning fully with US-led geopolitical frameworks. They advocate a multipolar world order, engage with rival powers, and seek alternatives to dollar-dominated trade systems.

The US increasingly uses tariffs and sanctions as tools of geopolitical discipline. Rather than relying solely on diplomacy, economic pressure is deployed to enforce compliance on issues ranging from sanctions to technology transfer and military cooperation.

Impact on the Global Economy

If even a fraction of such tariff threats were implemented, the consequences would be severe. Global supply chains would face disruptions, commodity prices could surge, and inflationary pressures would intensify worldwide. Developing countries would suffer disproportionately, while consumers in the US would face higher prices.

Such actions could also accelerate de-dollarization efforts, strengthen regional trade blocs, and weaken institutions like the World Trade Organization. Countries targeted by tariffs would likely retaliate, leading to a spiral of protectionism reminiscent of pre-globalization eras.

How India, Brazil, and China Might Respond

India may seek diplomatic exemptions, diversify export markets, boost domestic manufacturing, and strengthen South–South trade. Brazil could deepen ties within Latin America, China, and Africa, while China would likely respond with counter-tariffs and further decoupling from US technology and finance systems.

All three nations are likely to push harder for alternative financial systems, local currency trade, and stronger multilateral cooperation outside Western frameworks.

Conclusion

The debate over a 500 percent tariff on India, Brazil, and China highlights a fundamental shift in global trade politics. Trade is no longer just about economics; it is about power, influence, and control over the future world order. While such extreme tariffs may remain a threat rather than reality, their very discussion reflects growing instability in international relations.

For the global economy, the key question is whether cooperation and negotiation can prevail over confrontation. For India, Brazil, and China, the challenge lies in protecting national interests while navigating an increasingly polarized and punitive global trade environment.