Although a large number of these provisions have existed for quite some time and are not entirely new in nature, their implementation and monitoring have become significantly more rigorous in recent years. This change is largely due to improved coordination and more efficient data-sharing mechanisms among banks, registrars, and tax authorities. As a result, information that was earlier fragmented or difficult to track is now easily accessible across institutions, enabling authorities to detect discrepancies more quickly and ensure higher levels of compliance.

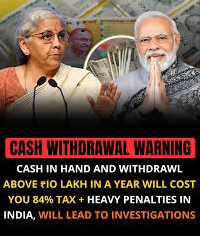

With stricter income tax rules coming into force, cash dealings in India may soon become far more expensive. Investment banker Sarthak Ahuja has cautioned that any unexplained cash discovered during tax searches could now be taxed at an effective rate of up to 84%, once penalties, surcharges, and cess are added. This move is expected to significantly discourage unaccounted cash transactions.

The Price of Cash has gone up

Ahuja’s post draws attention to the most important aspects of India’s updated cash-handling regulations and highlights the severe financial consequences that individuals and businesses may face if they violate these rules. He emphasizes that the new framework is designed to be far stricter than before, leaving little room for non-compliance or ignorance of the law.

“Everyone needs to be fully aware of the regulations that are now being enforced,” Ahuja wrote, underlining the seriousness of the situation. He specifically pointed out that if the Income Tax Department discovers unexplained cash during a search or seizure operation at a person’s home or business premises, the authorities can impose a tax liability of as much as 84% on that amount. This effectively means that most of the unaccounted money would be lost in taxes and penalties.

According to Ahuja, the bigger issue is not just the harsh penalties but the significantly increased likelihood of coming under scrutiny. He warned that with enhanced monitoring systems, data tracking, and stricter enforcement mechanisms now in place, the chances of individuals or businesses being flagged by tax authorities have never been higher. As a result, he urges people to remain vigilant, maintain proper documentation, and ensure full compliance with the law to avoid serious financial and legal repercussions.

How the Tax Department Finds Out

The Income Tax Department is automatically alerted to high-value cash transactions. According to Ahuja:

-

If a person withdraws more than ₹10 lakh in cash during a financial year, the bank is required to report the transaction to the Income Tax Department.

-

If cash withdrawals exceed ₹20 lakh, the bank will deduct TDS (Tax Deducted at Source) on the amount withdrawn.

-

Making frequent large cash withdrawals may draw scrutiny from the department and could lead to a search or seizure, especially if the source of the funds cannot be properly explained.

No Acceptance of Illicit or Under-the-Table Cash Transactions

Certain transactions now carry a 100% penalty, which means you may end up paying double the amount involved:

-

Receiving more than ₹2 lakh in cash from a single customer in one day

-

Accepting cash loans of any amount

-

Receiving more than ₹20,000 in cash while selling property

Ahuja cautions that these rules are strictly enforced and already in effect. “With the vast amount of transaction data now available, the government can easily track and identify violations,” he warns.

Why It Deserves Attention Right Now

These regulations form part of the government’s wider effort to curb black money, undisclosed wealth, and informal financial dealings. Although several of these measures have existed for some time, enforcement has become far more rigorous due to improved data-sharing among banks, registrars, and tax authorities.

For individuals and small businesses that traditionally rely on cash transactions, the message is unmistakable: maintain proper documentation—or face the risk of severe financial consequences.