Mexico has passed sweeping new tariffs of up to 50% on more than 1,400 imported products from Asian countries without free-trade agreements, marking a major shift in the country’s long-standing free-trade posture and drawing immediate attention from governments across the region — including India.

The move aligns Mexico more closely with US President Donald Trump’s protectionist trade strategy as both countries navigate high-stakes negotiations over industrial supply chains.

What tariffs has Mexico approved?

Mexico’s Senate on Wednesday voted to impose tariffs ranging from 5% to 50% starting next year. The new duties will apply to a wide variety of goods including:

- clothing and textiles

- metals

- machinery and industrial components

- auto parts and finished vehicles

The bill passed with 76 votes in favor, five against and 35 abstentions.

Why it matters for India

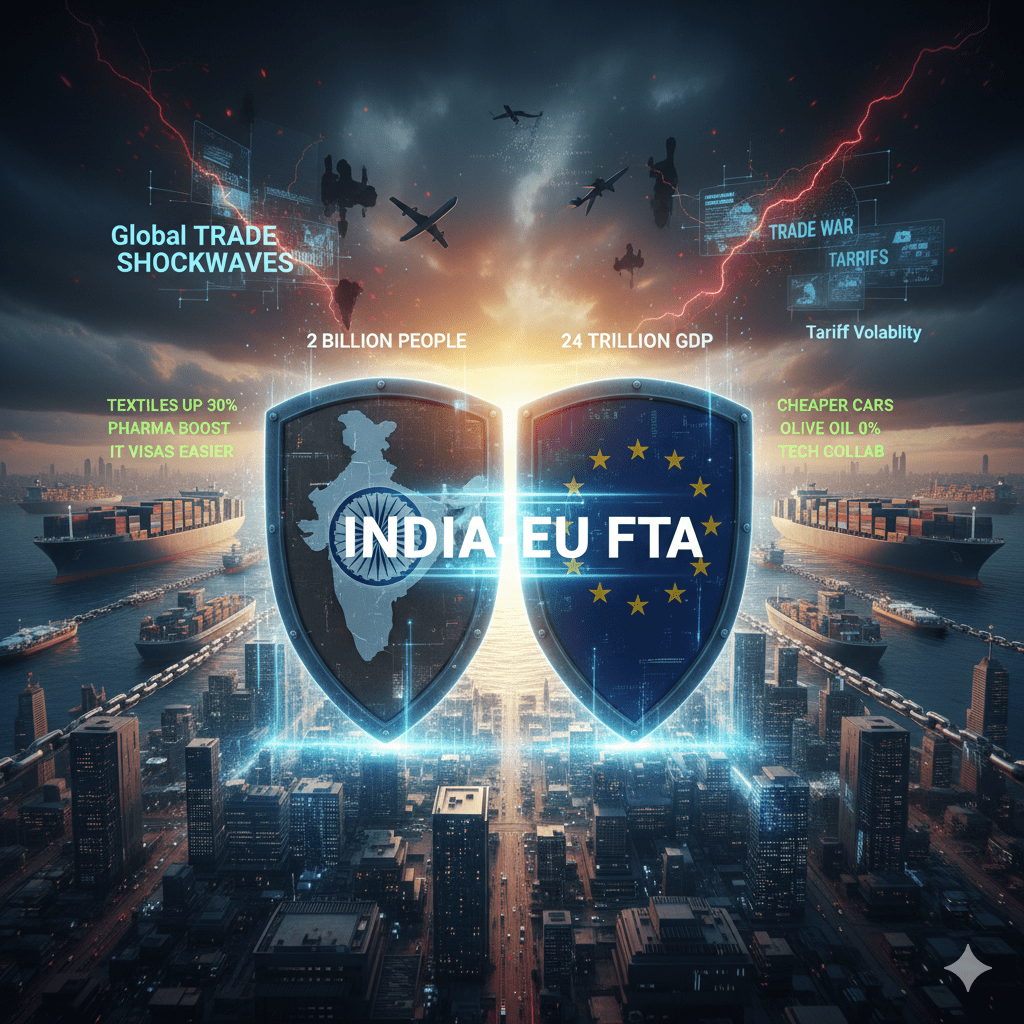

India, which has sought to boost exports of textiles, auto components and engineering goods to Latin America, now faces a significantly more challenging entry into the Mexican market, the second-largest economy in the region and a key North American gateway. Indian exporters have long leveraged Mexico as a stepping stone to the US, thanks to its integration in North American supply chains.

Implications for India and the region

For Indian exporters, the tariff shift could:

– Reduce competitiveness in industries such as textiles, leather goods, auto parts and steel.

– Push companies to reconsider supply-chain routing through Mexico.

– Increase landed costs for Indian firms operating in or supplying to North American value chains via Mexico.

India’s commerce Ministry has not issued a statement yet.

Washington’s shadow over Mexico’s move

Analysts, including those in India tracking Latin American markets, believe Mexico’s sudden protectionist turn is closely tied to pressure from the United States ahead of next year’s USMCA (United States-Mexico-Canada Agreement) review.

President Claudia Sheinbaum’s government is understood to be signalling alignment with Washington’s tougher stance on Chinese goods, hoping this might help ease the sweeping US tariffs that have hit Mexico’s own exports such as steel and aluminium.

Although Sheinbaum denied the tariffs are linked to US demands, the structure of the new duties strongly mirrors American trade actions, a Bloomberg report noted.

The version passed this week is milder than an earlier proposal, which had sought strict duties across nearly 1,400 tariff lines. Lawmakers have now reduced the severity of tariffs on about two-thirds of those categories.

Even so, the Mexican finance ministry expects the new levies to bring in nearly 52 billion pesos ( ₹19,000 crore) in additional revenue next year, money the government says it needs to narrow its fiscal deficit.

Is India impacted by Mexico’s new tariff regime?

India does not have a free-trade agreement with Mexico, placing it within the group of countries directly affected by the new tariff structure.

Mexican importers relying on Indian:

- machinery,

- automotive components,

- textiles,

- pharmaceuticals, and

- chemical products

- may face higher costs depending on the final tariff schedule.

While the Mexican government has not highlighted India specifically, the broad phrasing of the legislation — covering all non-FTA partners — means Indian exporters will almost certainly be affected. The scale of the impact will depend on the categories into which New Delhi’s major export lines fall.

Why is the policy shift so significant?

For decades, Mexico has been one of the Western Hemisphere’s most open economies, signing more than 50 free-trade agreements globally. The new tariff policy marks a notable departure from that tradition.

The legislation also grants Mexico’s Economy Ministry new authority to adjust tariffs without requiring congressional approval. The bill states that the ministry “may implement specific legal mechanisms and instruments for the importation of goods from countries with which the Mexican state does not have a free trade agreement in force,” enabling rapid adjustments in response to market disruptions.

This flexibility is expected to be important ahead of next year’s planned review of the USMCA agreement with the United States and Canada.

More changes ahead

The legislation also gives Mexico’s Economy Ministry sweeping authority to revise tariffs on non-FTA countries at will, enabling rapid adjustments ahead of the USMCA review. This new flexibility could mean more fluctuations in duty structures for Indian exporters.

With the US and Canada both tightening scrutiny on Chinese supply-chain routing, Mexico’s move underscores a broader North American shift toward protectionism.

What did the Mexican govt say?

Mexican President Claudia Sheinbaum’s government has argued that higher tariffs are needed to “protect local jobs and manufacturing,” even as business groups and the affected governments strongly oppose the move. “These adjustments will boost Mexican products in global supply chains and protect jobs in key sectors,” Emmanuel Reyes, who is chairman of the Senate Economy Committee, said Reuters reported. “This is not merely a revenue-raising tool, but rather a means of guiding economic and trade policy in the interest of general welfare,” he added. This comes amid America’s earlier imposition of a 25% duty citing trade deficits, followed by another 25% penalty over India’s purchase of Russian crude.

Which sector is the hardest hit ?

The tariff increase presents a significant challenge for India, whose automakers heavily rely on Mexico, India’s third-largest car export market after South Africa and Saudi Arabia. The duty on passenger cars will jump from 20% to 50%, affecting major exporters such as Volkswagen, Hyundai, Nissan and Maruti Suzuki. According to a Reuters report, Indian industry lobbied hard to stop the hike.

The Society of Indian Automobile Manufacturers (SIAM) urged the commerce ministry to intervene, warning, that, “The proposed tariff hike is expected to have a direct impact on Indian automobile exports to Mexico… we seek Government of India’s support to kindly engage with the Mexican government.

“The letter, reported for the first time, argued that Indian-made vehicles pose no threat to Mexico’s domestic industry, saying that “Indian-origin vehicles are not a threat to Mexican local industry as Indian vehicles do not cater to high-end segments manufactured by Mexico for serving the North American market.

“Automakers also told officials that India’s shipments to Mexico account for just 6.7% of the country’s annual passenger vehicle sales, which total about 1.5 million. With tariffs doubling on compact cars, India’s main export to Mexico automakers may be forced to reassess production plans and market strategies.

1 thought on “Mexico MASTERSTROKE for USMCA Leverage or a DIPLOMATIC BLOW?”